Fanatics has rapidly become a dominant player in the collectibles industry. We explore what it is doing to reshape the trading card market, the legal battles it faces, and what these changes mean for the sports card industry.

How Fanatics Secured Exclusive Licenses

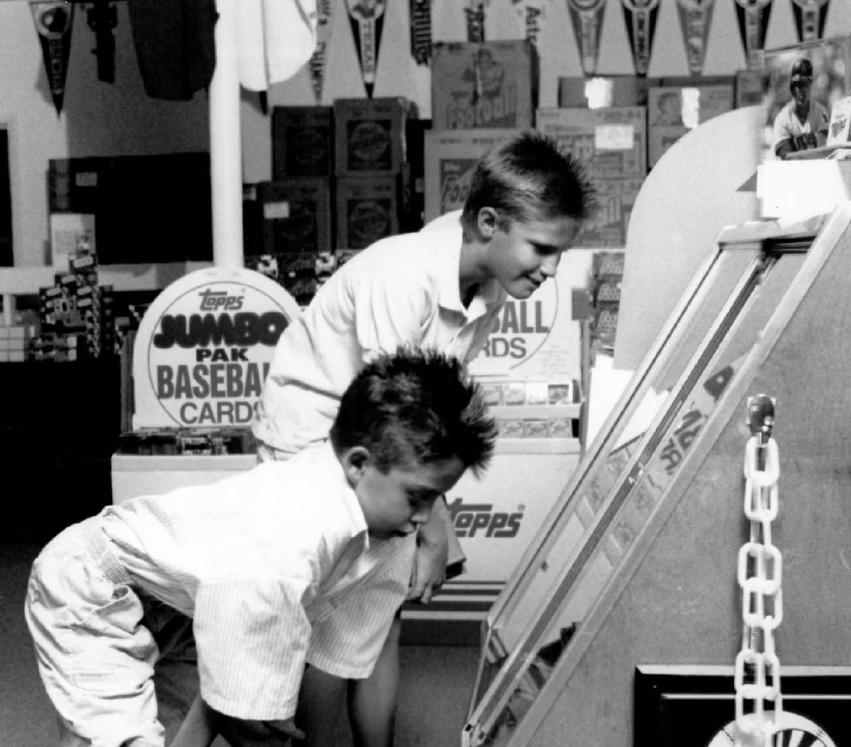

Fanatics’ entry into the sports card market began in August 2021, when it secured long-term exclusive licensing agreements with MLB and MLB Players Association, effectively sidelining Topps, a historic player in the industry. Fanatics didn't stop there. It also secured similar agreements with the NFL, NFL Players Association, NBA, and NBPA, establishing itself as the exclusive manufacturer of official trading cards across the biggest U.S. sports leagues.

This strategic move was aimed at achieving a direct-to-consumer model, bypassing traditional card distributors and retailers. By 2026, Fanatics will become the exclusive licensee for NBA cards, completing its takeover of the market’s most valuable segments.

The Shift to a Direct-to-Consumer Model

Fanatics’ strategy extends beyond exclusive licensing.

One of its main goals is to create a direct-to-consumer (DTC) ecosystem that not only produces and sells trading cards but also capitalizes on the aftermarket through resale channels like live streams, auctions, and its own marketplace. By eliminating middlemen, Fanatics claims it can lower costs for consumers and increase revenue for both the leagues and players, all while expanding the overall market.

The company aims to integrate trading card production, primary sales, and secondary sales into one smooth-operating ecosystem. This means that Fanatics not only profits from initial pack sales but also takes a cut from resales, creating new revenue streams previously untapped by card manufacturers.

Fanatics and Aftermarket Sales

As we've mentioned, Fanatics' innovative move was to monetize aftermarket sales.

Traditionally, trading card companies like Topps or Panini made money primarily through the first sale of packs or boxes. However, Fanatics has reimagined this model by building an ecosystem where both initial sales and resales occur on its platform. Fanatics plans to leverage live-streamed card openings, real-time auctions, and exclusive player signings to drive excitement and demand.

This model is inspired by global e-commerce platforms like Alibaba and Shopee, where live commerce has proven highly successful. Controlling these resale channels allows Fanatics to increase its revenue and enhance its market data, enabling the company to fine-tune its production and distribution strategies based on real-time consumer behavior.

Panini’s Antitrust Lawsuit

Fanatics’ rapid expansion and exclusive contracts have not gone unchallenged.

In August 2023, Panini America filed an antitrust lawsuit against Fanatics, accusing it of creating a new monopoly that spans multiple leagues and players' associations. The lawsuit alleges that Fanatics engaged in “calculated, intentional, anticompetitive conduct,” such as signing rookie athletes to exclusive deals, spreading false information about Panini, and aggressively recruiting Panini employees.

David Boies, chairperson of Boies Schiller Flexner and Panini’s legal counsel, told CNBC that Fanatics’ lawsuit represents “a desperate attempt” to sidestep the antitrust issues detailed in the lawsuit filed against it last week.

Panini also highlighted how Fanatics used its market position to threaten suppliers—such as preventing Panini from acquiring jerseys needed for memorabilia cards, effectively disrupting Panini’s product lineup.

Furthermore, Fanatics has also made significant investment into the factories like GC Packaging that make the cards for Panini themselves. Fanatics has executed their plan of being optimally vertically integrated. The excellent execution and strategy will be studied in business schools for years to come.

Fanatics’ Counterclaims

Fanatics has not taken these accusations lightly.

The company quickly filed a counterclaim against Panini, describing the lawsuit as a desperate move by a company that has lost touch with its consumer base and failed to innovate. Fanatics maintains that it won its licenses “fair and square,” focusing on what’s best for the collectors, leagues, and players.

David Boies, chairperson of Boies Schiller Flexner and Panini’s legal counsel, told CNBC that Fanatics’ lawsuit represents “a desperate attempt” to sidestep the antitrust issues detailed in the lawsuit filed against it last week.

Fanatics also argues that the industry needed modernization.

According to Fanatics, the traditional model was plagued by slow product releases, unfulfilled redemption cards, and a lack of direct engagement with collectors. Taking a more integrated, data-driven approach, Fanatics claims, is elevating the hobby and expanding the market, not monopolizing it.

The company points to its innovations in the resale market, arguing that these measures increase liquidity and value for collectors. Fanatics maintains that it is simply adapting to new consumer demands, much like other industries transitioning to digital-first, direct models.

What Fanatics’ Takeover Means for the Card Industry

The trading card industry is going through a major transformation, unlike any seen in decades.

With Fanatics at the forefront, several potential outcomes are emerging:

1. Higher Prices & Limited Competition

- A key concern of Fanatics’ dominance is price inflation. With fewer competitors and long-term exclusive agreements, Fanatics could increase prices without fear of undercutting, making it costlier for collectors to participate in the hobby.

- The long-term nature of Fanatics' contracts (up to 20 years) prevents other manufacturers from entering the market, potentially stifling innovation and limiting consumer choice.

2. Increased Innovation & Improved Collector Experience

- Despite fears of a monopoly, Fanatics promises a more modern and engaging collector experience. Live-streamed card openings, integrated resales, and direct communication with collectors could make the hobby more exciting and interactive.

- Fanatics' data-driven approach could help predict demand more accurately, reduce production delays, and potentially create a more responsive market where collectors have better access to new releases.

3. Potential Legal & Regulatory Changes

- The ongoing legal battles between Panini and Fanatics could lead to regulatory intervention, particularly if the courts find merit in Panini’s antitrust claims. This could force Fanatics to alter its exclusive agreements or change its approach to licensing.

- Panini recently won in arbitration regarding the NFL license claim when the NFLPA tried to cancel their contract with Panini in favor of Fanatics.

- However, if Fanatics emerges victorious, the industry could see further consolidation, with the company expanding its reach into other collectibles and memorabilia markets.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.